Saving for the future .... in a nutshell (or Nutmeg)

Posted on

My eldest daughter sat on my bed last night, flicking through a promotional clothing magazine that had dropped through our letterbox and within half an hour, she had circled 40 items of clothing that she would like! 40 items of clothing in half an hour, that is good going, even by my standards. Raising girls with a shopping habit to rival my own is looking expensive!

I might be laughing now but I am conscious that as the girls get older, their clothing habits will be the least of my worries if they want to go to University or get a car. I know that there are lots of families consciously save for the future, whereas others believe in living for today by spending what they earn and I suppose I fall somewhere in the middle. My love of shopping for myself and the girls is no secret but I am always aware of the need for a "college" fund at some point in the future and it is scary how quickly that future will arrive.

Experian published research last year claiming that about one in five parents of students have faced financial pressures to support their children. This includes paying for accommodation, travel and utility bills. "University can be an extremely expensive time for parents and students alike," said Experian's Julie Doleman ....... I really had better start saving now and keeping an eye on the piggy bank!

Having a seperate account to keep savings in makes a big difference because you can keep an eye on your savings targets and with something like an ISA, gives you the freedom of saving but with easy access in case you need it!

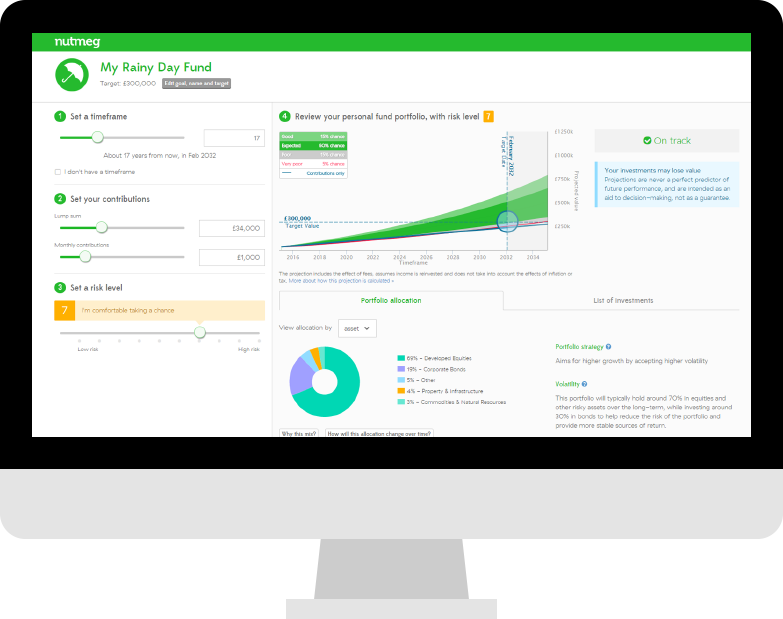

I was recently introduced to Nutmeg and were impressed with their no nonsense approach. They have got rid of all the aspects that made the wealth management industry unpopular. They don’t try and baffle you with jargon or lump all your money together and they don’t keep you in the dark over where you’re invested – or how your funds are performing.

They look to give you complete transparency – and, they say, complete peace of mind. We like the fact that they can help you set up your portfolio in under 10 minutes and you can create as many funds as you like. But I think my favourite part is that you can get in touch with us by telephone, email or live webchat, whichever you prefer, no sitting on hold forever and a day to a call centre on the other side of the world!

I remember investing money many many years ago and then being massively frustrated when I found that it was locked away and I couldn't get hold of it when I needed it, so fast forward a few years and I am a little more savvy about where we put our money (although the tween seems to think that it should all go on a new wardrobe for her apparently!).

Finding the right place to save for your future is something we all need to think about now and I know I need to be more cost conscious .... especially where the clothes shopping is concerned.

How much do you worry about saving for the future?

Add a comment: